Closing Entries: Step by Step Guide

By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings. Having a zero balance in theseaccounts is important so a company can compare performance acrossperiods, particularly with income. Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account.

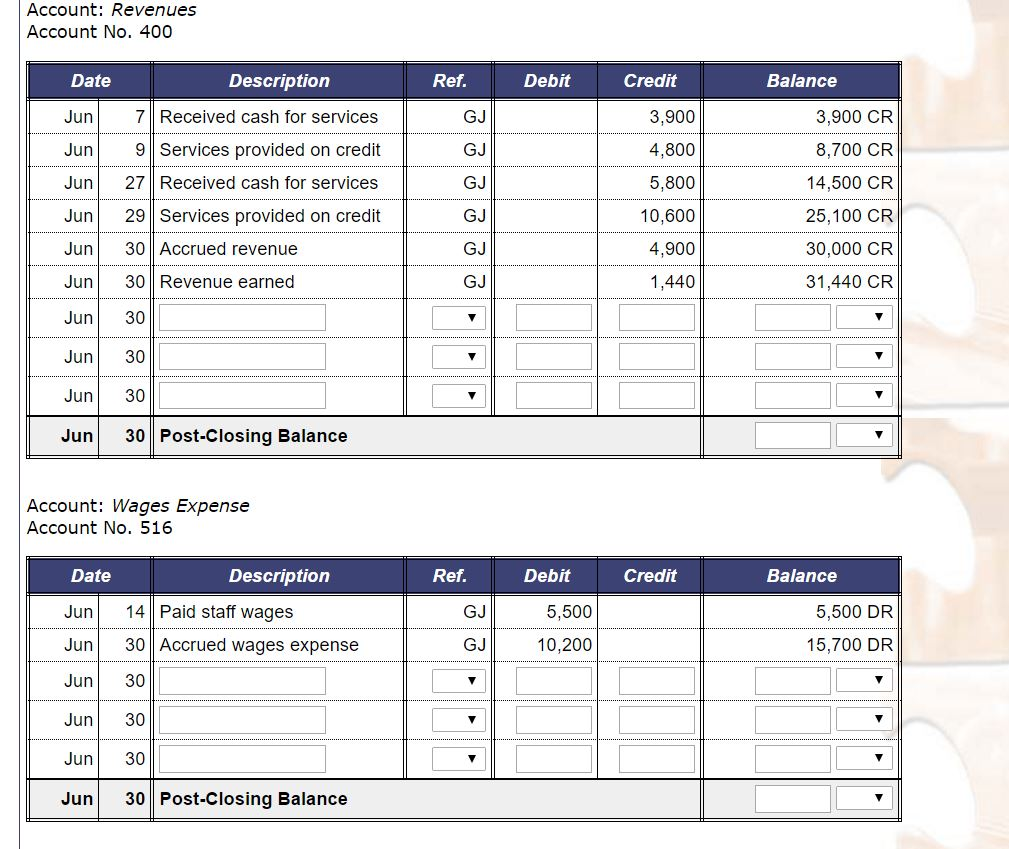

Step #2: Close Expense Accounts

This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations). In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. In addition, if the company uses several sets of books for its subsidiaries, the results of each subsidiary must first be transferred to the books of the parent company and all intercompany transactions eliminated. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company.

Closing Entries FAQs

- This is from the income summary to the retained earnings account.

- We have completed the first two columns and now we have the final column which represents the closing (or archive) process.

- In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. Closing entries are crucial for maintaining accurate financial records. HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate. At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors.

Monthly Financial Reporting Template for CFOs

Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted. Whenyou compare the retained harvest accounting earnings ledger (T-account) to thestatement of retained earnings, the figures must match. It isimportant to understand retained earnings is not closed out, it is only updated. RetainedEarnings is the only account that appears in the closing entriesthat does not close.

Frasker Corp. Closing Entries

This balance is then transferred to the RetainedEarnings account. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account. From this trial balance, as we learned in the prior section, you make your financial statements.

The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food. This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period.

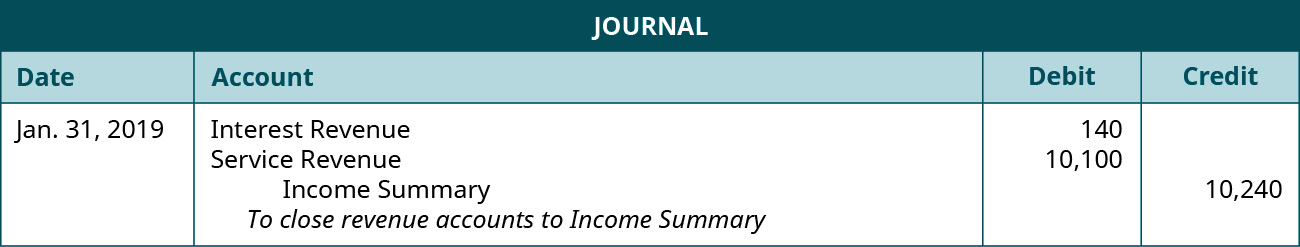

There may be a scenario where a business’s revenues are greater than its expenses. This means that the closing entry will entail debiting income summary and crediting retained earnings. But if the business has recorded a loss for the accounting period, then the income summary needs to be credited. The first entry closes revenue accounts to the Income Summary account.

Here you will focus on debiting all of your business’s revenue accounts. If dividends were not declared, closing entries would cease at this point. If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend. The second part is the date of record that determines who receives the dividends, and the third part is the date of payment, which is the date that payments are made.

Leave a Reply